Welcome

Hillrom colleagues!

You Belong Where Banking is Better.

As a Hillrom employee, you and your family have exclusive access to Credit Union membership* from BCU. You’ll find lower rates, greater rewards, and exceptional service – delivered by people who are committed to putting you first.

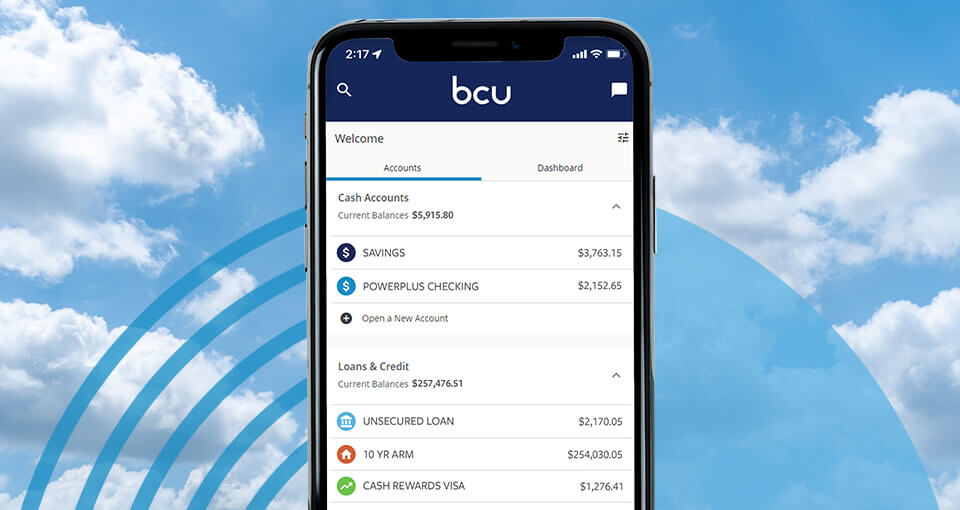

Download the Digital Banking app today!

The Credit Union is here to help you make your money go further.

Choose your skill-building tool:

-

Disclosure

1Offer available to TeamHealth associates who are legal U.S. residents 18 years of age or older unless prohibited by law. Non-members receive a $25 deposit for opening a new BCU membership using promo code TH25 and depositing at least $25 in the first 30 days of account opening. A person seeking Credit Union membership must also meet at least one of the criteria found at BCU.org/Membership-Eligibility. New members will receive the $25 as a deposit into their Share-01 Savings account within 30 days of account open date. The minimum qualifying deposit balance must remain in the account until time of funding. The incentive deposit to the new member is considered a bonus and may be reportable to the IRS on Form 1099-MISC (or Form 1042-S, if applicable). The new membership must be in good standing to receive offer. To be in good standing requires at a minimum: You are not in default of any loan or other obligation to BCU, You are not subject to any legal or administrative order or levy, You have not caused a loss to BCU as stated in our Expulsion Policy found at BCU.org/Legal-Terms-of-Use. Existing members are not eligible for the offer. No substitutions for deposit allowed. Offer limited to one (1) deposit per person. Void where prohibited. BCU's decisions are final and binding on all matters relating to this offer. BCU, at its sole discretion, may terminate, in whole or part, and or modify, amend, or suspend this promotion in any way, at any time, for any reason without prior notice. BCU employees and immediate family members are not eligible to participate in this offer. Sponsored by BCU, 340 N Milwaukee Ave, Vernon Hills, IL 60061.

2PowerPlus Checking

Effective 9/1/2024, the ATM fee reimbursement disclosure below will change. Level 1 ATM surcharge fees will be covered up to $10.00 per month and Level 2 ATM surcharge fees will be covered up to $20.00 per month.

Membership must be opened between 7/1/2024 and 12/31/2024 to receive this promotional offer. The 3-month introductory period begins the month the membership is opened and ends on the last calendar day of the 4th month. During the 3-month introductory period Level 1 will earn 4.00% APY and Level 2 will earn 8.00% APY. After the 3-month introductory period, balances up to $15,000 will earn the stated higher rate and the portion of the balance over $15,000 will earn the stated lower rate. See rate sheet or website for current rates. The member account must meet all requirements to achieve either Level 1 or Level 2 for all three months to be eligible to receive the respective higher APY.

To earn monthly dividends and reimbursements of other banks’ ATM surcharge fees up to $5.00 per transaction, your account must meet all three of these requirements to qualify for Level 1 or Level 2. Please note, ATM surcharge fees are covered up to $5.00 per transaction, any remaining ATM surcharge fee over $5.00 will not be reimbursed. Effective 9/1/24, the reimbursement will change as noted above. Level 1 accounts will be covered up to $10.00 per month and Level 2 accounts will be covered up to $20.00 per month.

To achieve Level 1, you must have monthly direct deposits totaling at least $1000 into your PowerPlus Checking account on an ongoing monthly basis, enrollment in eStatements and completion of at least fifteen (15) qualified transactions.

To achieve Level 2, you must have direct deposits totaling at least $3000 into your PowerPlus Checking account on an ongoing monthly basis, enrollment in eStatements and completion of at least thirty (30) qualified transactions.

Qualified transactions include any combination of the following: BCU Debit Card PIN, Debit Card signature, credit card purchases, Online Bill Pay or ACH payments, which will apply toward the monthly requirements in the month they post to your account. Credit card transactions that post on the last day of the month will be applied toward the following month’s transaction total. Accounts not meeting all monthly requirements will not earn dividends and will not receive reimbursements of other banks’ ATM surcharge fees.

Rates accurate as of 5/1/2025. The dividend rate and annual percentage yield (APY) may change at any time. Balances up to $15,000 will earn the stated higher rate and the portion of the balance over $15,000 will earn the stated lower rate. See rate sheet or website for current rates. There is no minimum balance required to earn dividends. Dividends are paid monthly and calculated based on the average daily balance method. Fees may reduce earnings.

PowerPlus Checking is available as a personal account only and is limited to one account per member. When Opted In, if you do not have sufficient available funds in your checking account to clear a presented item, funds may automatically transfer from your savings or money market share and may count towards withdrawal limitations for that savings or money market share (Electronic funds transfers from savings and money market shares, which include overdraft transfers are limited to six per month). Each electronic funds transfer in excess of six per month is subject to a $3 excessive withdrawal fee. See Service Charges and Fees Schedule in Consumer Member Service Agreement for further details. PowerPlus™ Checking is a trademark of BCU.2A Direct deposit allows you to receive payroll and other electronic deposits up to two days ahead of your scheduled payday. It’s important to note, funds are not AVAILABLE for you to spend until they are reflected in the AVAILABLE BALANCE. Please be sure to confirm available funds in your account before withdrawing against this deposit. While BCU will try wherever possible to advance payroll direct deposits by up to 2 days, availability of funds ahead of the original scheduled pay date is not guaranteed. You should not rely on direct deposit to satisfy the needs of scheduled bill or loan payments, or any other date-sensitive financial obligations.

3To be eligible for the corporate mortgage benefit program (CMBP) closing cost discount, you must be a current employee at a participating BCU company partner. You may need to provide proof of employment or affiliation. For first mortgage purchase and refinance transactions of a primary residence, the maximum CMBP closing cost discount is $1,000. CMBP closing cost discount and relationship pricing rate discount may be eligible to be combined. CMBP closing cost discount may not be combined with any Relocation Services program benefits, or any other home loan promotional mortgage offers. Only one offer may be applied per transaction. Certain mortgage types and/or terms may not be eligible for the closing cost discount. Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice.

4You will automatically earn 2.0% cash back on qualifying net purchases (purchases less any credits, returns, and adjustments). Cash advances, balance transfers, and checks used to access your account will not earn rewards.

5Offer only available on new accounts. You will receive a $200 cash bonus after making purchases totaling at least $1,000 (exclusive of credits, returns and adjustments) that post to your account within 90 days of the account open date. Account must be in good standing (i.e., not canceled or terminated, not delinquent, over limit, or otherwise not available to use for charges) to receive the cash bonus. After qualifying, the cash bonus will post to your rebate balance within one billing cycle.